Looking to save money and maximize travel rewards on a Disney vacation? A Disney credit card has long been a popular choice among Disney-going travelers for doing just that.

Until yesterday, however, I was pretty lukewarm on Disney's credit card offerings from Chase. For many years, the cards offered a limited value proposition, especially in the sea of premium travel rewards cards flooding the the market the past few years that return much more compelling bonuses and travel rewards.

As of February 3, 2026, however, Disney and Chase just debuted a third card in the Disney's credit card portfolio - the Disney Inspire Visa Card - that makes me more bullish on (at least one of) the Disney offerings.

Is a Disney credit card worth your wallet space? For many Disney parks and entertainment loyalists, I finally think so. Let's dive in to analyze whether you are one of those people, which card you should get if so, and how you can maximize the value of a Disney card's perks.

A Word of Warning

As someone who has been deeply involved in the world of travel loyalty and rewards programs for going on two decades, I know that credit cards can be incredibly useful tools to save money on your family’s vacations. There are a plethora of airline miles cards, hotel cards, flexible points cards, and cash-back cards out there in the world. Choosing the right one (or ones) requires research and a detailed cost-benefit analysis.

But credit cards also come with risk and potential for making serious financial mistakes. Everyone should tread carefully. Read up on more of my tips and advice on miles and points so you can make smart decisions with rewards credit cards.

Disney Credit Card Basics

One of the credit cards many families bound for a Walt Disney World, Disneyland, Aulani, or Disney Cruise Line vacation often consider is a Disney card offered by Chase.

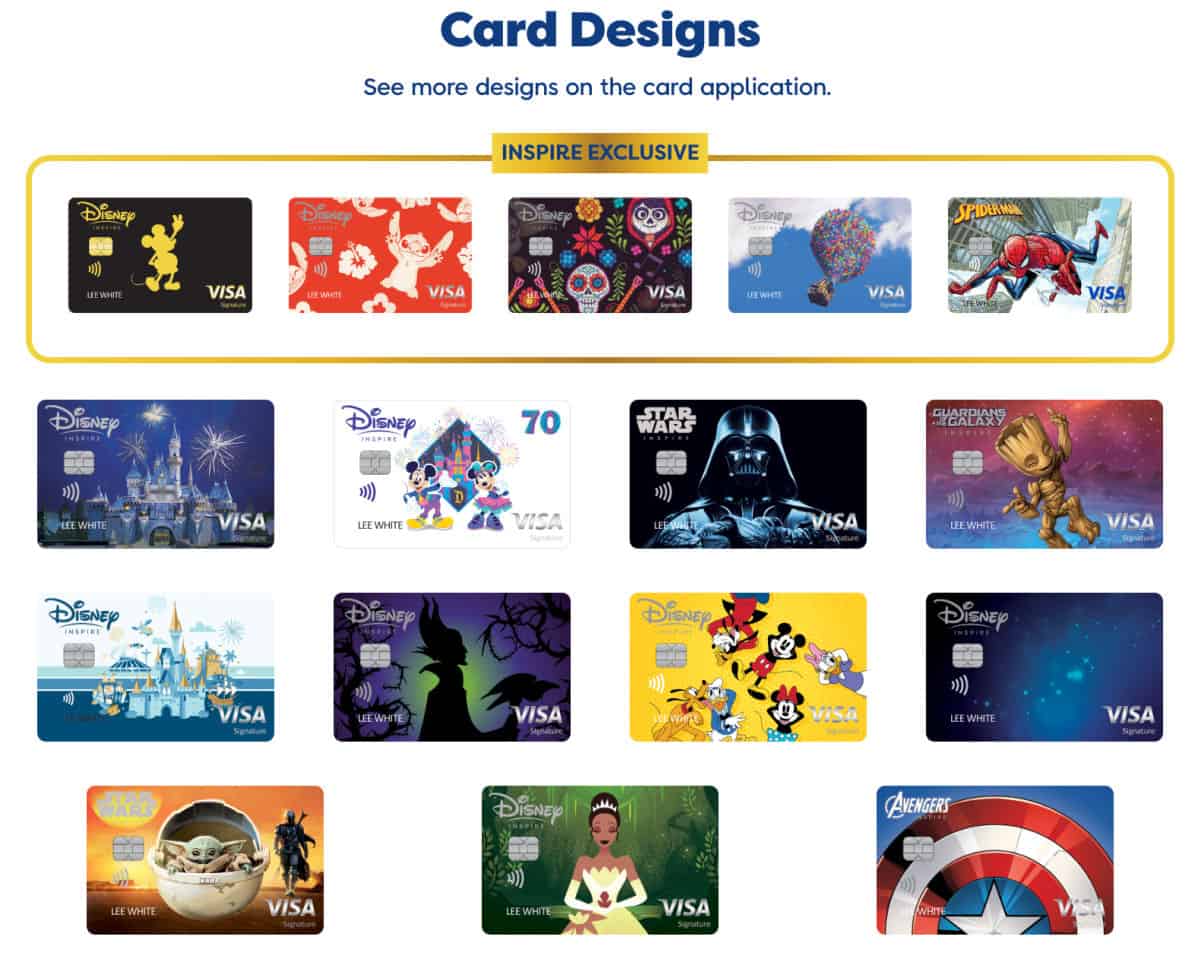

Disney's cards earn Disney Rewards Dollars you can use towards a future vacation. They also come in lots of cute card designs. Pulling Mickey or another favorite Disney character out of your wallet every time you purchase something definitely brightens up a bad day in between Disney vacations.

Chase now offers three card varieties (in order of lowest to highest annual fee):

- Disney Visa Card

- Disney Premier Visa Card

- Disney Inspire Visa Card (NEW!)

As of February 2026, all three cards have interest rates of 18.74% to 27.74% depending on your creditworthiness (yikes!). With that rate, these cards are definitely not for anyone who carries a balance. Paying interest would more than cancel out any rewards earned.

If you pay your credit cards in full each month, however, how do you analyze whether the Disney cards are a good fit for you and your family? And how do you choose between the card options?

When evaluating any reward earning credit card, there are four important features I compare:

- the annual fee

- the signup/welcome bonus

- rewards earned for spending, and

- incidental perks and other discounts.

(Of course features like the interest rates and other fees matter, but you aren't paying interest or late fees, right?).

Very few credit cards are standouts in all four areas. The Disney cards are no exception to that rule. Let's walk through all of these features to help determine whether these cards are worthwhile to you depending upon your travel goals and spending patterns.

Annual Fees on Disney's Credit Cards

Disney's three cards have pretty accessible annual fees, especially in the world where some premium rewards cards are now charging fees that approach four figures. The current fees are:

- Disney Visa Card: No annual fee

- Disney Premier Visa Card: $49 annual fee

- Disney Inspire Visa Card: $149 annual fee (NEW!)

Fees are not waived the first year you have a card, unlike some rewards credit cards, so you'll be paying these straight away to take advantage of the perks and bonuses.

Disney Credit Card Signup Bonuses

One of the reasons many families get a rewards credit card is to take advantage of a generous signup bonus. These bonuses hit your account quickly, usually after meeting a required initial spend in a short period of time. Credit card welcome bonuses are a great way to get some near instant gratification and make significant headway towards free travel.

Some airline and hotel cards regularly offer signup bonuses as large as 50,000-100,000 miles or points. These can sometimes equal over $1000 in travel value depending on how the recipient redeems them.

The Disney cards from Chase, in comparison, have traditionally offered fairly modest signup bonuses. The newest (and most expensive) Inspire card, however, is more lucrative and now is at least competitive when it comes to a welcome offer.

As of February, signup bonuses on the current public offers are:

- Disney Visa Card (no annual fee): $150 in value ($100 returned as a Disney Gift Card upon approval + $50 statement credit after spending $500 on the card within 3 months after account opening)

- Disney Premier Visa Card ($49 annual fee): $300 in value ($200 returned as a Disney Gift Card upon approval + $100 statement credit after spending $500 on the card within 3 months after account opening)

- Disney Inspire Visa Card ($149 annual fee): $600 in value ($300 returned as a Disney Gift Card upon approval + $300 statement credit after spending $1000 on the card with the first 3 months after account opening)

If you have a friend or family member who already has a Disney card, you should check with them before applying for one of the publicly available offers. Disney occasionally sends refer-a-friend codes to current cardholders that give a somewhat more generous signup offer.

All the cards offer a signup bonus that more than exceeds the annual fee the first year, so all of them are theoretically justifiable for someone who can meet the modest minimum spend for at least a year.

But paying a higher annual fee gives you a much bigger signup bonus. Moving from the regular Visa to the Premier, for example, and paying just $49 gives you an extra $150 in return. And moving from that same no annual fee Visa all the way to the new Inspire card by paying a $149 fee gives you an extra $450 in return. The increased bonuses more than cancel out the differences in annual fee from a less expensive card to a more expensive card. This makes the Inspire card the most lucrative out of the gate.

How does the Inspire's signup bonus compare to similar travel rewards cards? It's not the best there is, but it's solid. For sake of comparison, consider Southwest Airlines' credit card portfolio which is also with Chase. The standard signup bonus on the $149 annual fee card (Southwest Premier) is 50,000 Rapid Rewards points for spending $1000 in 3 months. Southwest points are worth about 1.2-1.3 cents per point when redeemed for airfare, making that signup bonus worth $600-$650 in value - comparable with Disney's Inspire card. (Note: Southwest and Chase have offered limited time sign up bonuses as high as 85,000-100,000 points on this card, usually with higher minimum spending requirements, so you can do better.)

Rewards Earned for Spending with Disney Credit Cards

All of the Chase Disney cards earn rewards in the form of Disney Rewards Dollars. These dollars can be redeemed by requesting a Disney Rewards redemption card from Chase or at Disney parks. These redemption cards work like Disney gift cards that can be spent on most Disney purchases (although not at the non-United States parks).

The no annual fee Disney Visa Card earns a flat 1% rewards everywhere (1 Disney dollar per $100 spent).

The Disney Premier Visa Card earns 2% rewards at gas stations, grocery stores, restaurants, and most Disney locations (2 Disney dollars per $100 spent) as well as 1% everywhere else. It also earns 5% on card purchases made directly at DisneyPlus.com, Hulu.com or Plus.ESPN.com.

The newest Disney Inspire Visa Card earns 3% at gas stations and most Disney locations (3 Disney dollars per $100 spent), 2% rewards at grocery stores and restaurants, and 1% everywhere else. It also earns 10% on card purchases made directly at DisneyPlus.com, Hulu.com or Plus.ESPN.com.

The Disney Inspire also has three more spending perks the other two cards don't have. First, It earns 200 Disney Rewards Dollars when you spend $2,000 on U.S. Disney Resort and Disney Cruise Line bookings - essentially a 10% rebate on your first $2000 in spending each year on Disney hotels, cruises, or vacation packages. Second, it also offers a $100 statement credit after spending $200 on U.S. Disney theme park tickets. (Both benefits are offered per anniversary year, so they reset not on January 1 each year but rather on the date you were approved for the card.)

Finally, it gives a $10 statement credit each month (up to $120 in value per year for subscribers who pay monthly) for streaming subscriptions to Disney+, Hulu, and ESPN.

For families who regularly visit Disney destinations and consume Disney entertainment, this means you can get up to $420 additional value each year from the Inspire. For many Disney fans, being able to take advantage of even some of these rewards will more than pay for the Inspire's higher annual fee compared to the other two cards. (And that's without even considering the increased earning the card gives you due to the better category spending bonuses like at gas stations).

Speaking of category spending bonuses, none of them are that revolutionary for any of the Disney cards. There are now a lot of rewards cards that give 2x-5x spending on restaurants, gas stations, or groceries. But the Inspire gives 2x-3x on all of these on a single card which is convenient for families who don't want to juggle multiple cards for each and every category.

Disney Credit Card Perks & Discounts

Although the signup bonus and rewards earnings do most of the heavy lifting when it comes to comparing Disney's credit cards (especially for the first year), there is one more feature to consider - the extra perks!

All of these cards offer discounts and special access that can really go a long way to making a Disney-loving family’s Disney vacation even better, so they may be worth keeping in your wallet beyond year 1.

So what are these perks? Having any of the Disney cards entitles the holder to the following additional perks and discounts:

- 6 months 0% financing on Disney vacations and Disney Vacation Club purchases;

- 10% discounts on purchases at the Disney Store and DisneyStore.com (with code DRVCMEMBER) and on purchases at select merchandise locations at Disney theme parks and resorts when mentioning the offer;

- 10% off select dining and 10-15% off select experiences at Disneyland and Walt Disney World;

- Special Disney Cruise Line perks and discounts; and

- Private character meet and greet with free photo download at Disneyland and Walt Disney World.

Disney cards sometimes have other unannounced perks as well. In the past, cardholders have been able to have early access to free dining promotions at the Walt Disney World Resort. Additionally, there are limited time promotions and discounts continuously announced to keep card holders coming back.

Are these perks enough to justify keeping a Disney card? Maybe. If you have the no annual fee card then they do because there is no cost to hanging on to a card you already have. And, if you can justify one of the annual fee cards (especially the Inspire) due to its other spending bonuses because you are frequent Disney traveler, these additional perks and discounts are just a cherry on top.

Hold that Thought: What About the Disney Debit Card?

There's one curveball everyone should consider before getting a Disney credit card. Disney also offers a debit card version, complete with cute card designs. You have to be a Chase checking customer to be eligible.

While debit card holders don't earn any Disney Reward Dollars or get a signup bonus, the do get the same perks/discounts as the Disney credit cards, including:

- 10% discounts on purchases at the Disney Store and DisneyStore.com (with code DRVCMEMBER) and on purchases at select merchandise locations at Disney theme parks and resorts when mentioning the offer;

- 10% off select dining and 10-15% off select recreation experiences at Disneyland and Walt Disney World;

- Special Disney Cruise Line perks and discounts;

- Private character meet and greet with free photo download at Disneyland and Walt Disney World.

The bottom line - if you are mostly in this for the perks and some Disney discounts, the debit card will get you those - no other strings or fees attached. Of course, if you aren't already a Chase checking customer, there are some startup hoops to jump through first.

Analysis: Should I Get A Disney Credit Card?

So, is the Disney credit card right for you and your family? The answer, of course, depends on what your travel goals are as well as what your spending habits are.

For many years (before the Inspire card existed), I recommended that most family and Disney travelers start with other cards - like the ones in my guides to the best rewards credit cards for Disney travel or top rewards credit cards for traveling families. I still believe that a general travel rewards card probably is a better first card, but the Inspire card is now pretty compelling too.

If you travel to Disney regularly, there's a strong case that the Inspire could be a valuable second or third card to add to your wallet. I've never had a Disney credit card personally (even as much as I travel to Disney!), but I'm strongly considering this one in the immediate future because the math finally adds up to something valuable for Disney fans like me.

Get a Disney credit card from Chase!

If you are a new applicant, I'd skip the other two cards entirely. The sign up bonuses are small, and the rewards for every day spending are weak. And if you don't go to Disney often enough to justify the Inspire card, why are you even getting a Disney credit card at all? You probably are better off with a cash back card or a card from a hotel or airline you use more regularly.

An additional question is always whether to hang on to the card past the one year mark when a hefty signup bonus isn't in play anymore. The Inspire's $420 in spending bonuses and rebates more than justify the annual fee, but only if you are someone who is going to use several of the perks each year. If you take a year or two off of Disney travel, you'll at most get the $120 rebate on streaming services which won't quite cover the $149 annual fee.

But if you are an Annual Passholder/Magic Keyholder AND a Disney+ subscriber, for example, you'll be able to trigger the $100 credit for park tickets and the $120 for streaming and the card more than pays for itself.

Because a lot of us can't predict our travel plans years in advance, I think a lot of folks may want to start with the most expensive card for one year for the better bonus (especially if you already know you have a Disney trip on calendar in the next 12 months). Then you can cancel or downgrade to the no annual fee card later if you find aren't getting value out of the card's other rewards. No guarantees a downgrade can always be done, but anecdotally this has been commonly allowed for many years.

If you do keep the no annual fee version of the card, I wouldn't put any everyday spending on it, as the regular rewards earnings are so anemic. Instead, hold it and use it exclusively for the Disney spending that triggers the merchandise and dining discounts.

Final Thoughts

A few other considerations for the super geeky, pulled from the fine print:

- Even the best earning card, the Inspire, only earns 3% rewards on Disney vacation spending like hotels and theme park tickets. If you have a Target Red Card, you can buy Disney gift cards at a 5% discount that you can use to pay for Disney hotels, cruises, etc. - a better rate of return. But if you aren't playing that game, 3% back on a Disney vacation is better than or equal to most other travel rewards cards.

- To get the $100 credit for theme park ticket purchases, you have to spend $200 with Disney direct. But Disney's direct park ticket prices are more expensive than authorized ticket resellers like Get Away Today, so this $100 rebate isn't quite worth $100. I'd instead put just one or two tickets on the card sufficient to trigger the rebate, and buy other tickets for everyone else in my family at the discounted prices from Get Away Today.

- Even if you already have one of the two less expensive Disney credit cards, it appears you can still apply for and get the better welcome bonus for the Disney Inspire Visa Card. (Fine print limits the welcome bonus only to cardmembers of "this credit card" as follows: "This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.")

- Since Disney's cards are issued by Chase, Chase's informal 5/24 rule applies - you won't be approved for this card if you've gotten more than 5 credit cards (including cards that you are an authorized user on) in the last 24 months. This isn't a limit that many Trips With Tykes readers will ever bump up against, but if you play the reward credit card game more heavily, you might.

The bottom line? A Disney credit card is right for families who don’t carry a credit card balance, who visit a Disney destination at least once a year or more, and who like and use Disney-related discounts and perks. As among the three Disney credit card options, there's now a clear winner - the new $149 fee Disney Inspire.

How to Save on a Walt Disney World or Disneyland Vacation!

No matter what Disney coast you are visiting, saving money is always a welcome bonus! Trusted Trips with Tykes partner Get Away Today sells park tickets at a discount, helps you find great deals at both on-property and off-property hotels, and provides expert customer service from representatives who visit Disneyland and Disney World all the time.

To snag discount park tickets that easily link immediately with your Disney app and Disney's reservations systems, click here:

For even bigger package discounts with on or off-property hotel deals, use these links:

- Browse and book discount Disney World vacation packages (Disney World packages include Get Away Today's concierge service!)

- Browse and book Disneyland hotel+ticket vacation packages (use code Tykes10 to save $10 extra!)

Debra says

You don't have to fuss with a redemption card anymore with the advent of Chase's Pay Yourself Back feature. Any qualifying purchase can be redeemed for a statement credit with reward dollars for up to 90 days. On the Premier and Inspire, qualifying purchases are Disney and airlines, and on the basic it's just Disney.

Ward says

Ok - tell me if my math is wrong here:

But if you don't even go to the parks or on a cruise - but you have Disney+ -- the Inspire card gives you a $10 credit AND 10% back in Disney Dollars. So - if your Disney+ bill is $50 - you'd get $15/month = $180/year ($120 in statement credit and $60 in Disney Dollars). Since it's a Chase card - you can use the "Pay Yourself Back" to convert the Disney Dollars to a statement credit for "Disney Purchases" - and Disney+ counts. So..... in "girl math" - Just getting the Inspire card to put a Disney+ membership on it could theoretically give you one month of Disney+ for $19 every year ($50-$31 -- the $31 coming from the difference between savings/Disney dollar's and annual fee $180-$149). You're making money at that point. Sure - it's small money and you're not maxing out the cards total potential - but it's money. Any additional Disney spending you do on top of Streaming would be icing (or pixie dust if we're staying on brand).

Or am I reading that wrong?